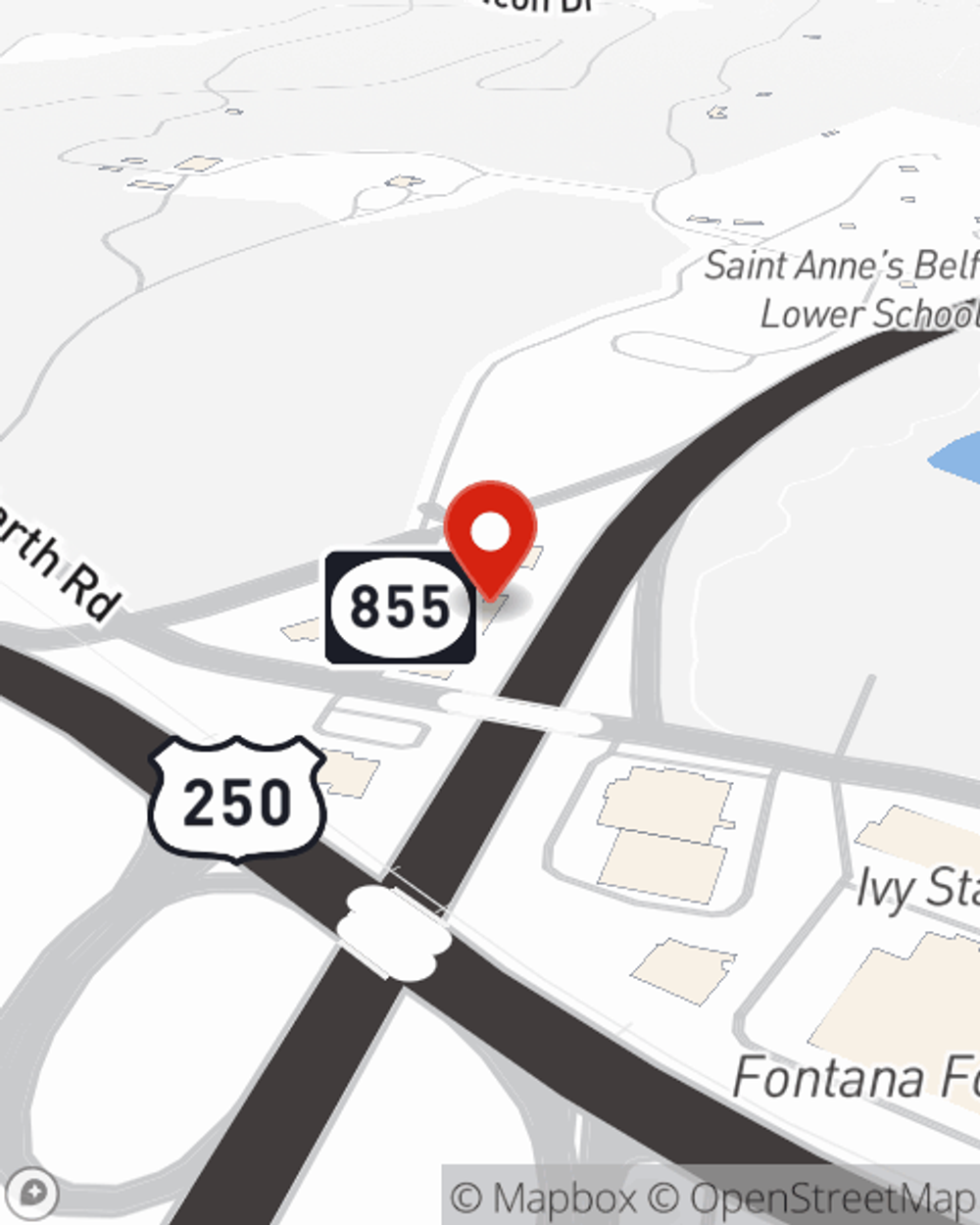

Life Insurance in and around Charlottesville

State Farm can help insure you and your loved ones

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

It's Never Too Soon For Life Insurance

There's a common misconception that Life insurance is only needed when you become a senior, but even if you are young and just starting out in life, now could be the right time to start learning about Life insurance.

State Farm can help insure you and your loved ones

Life won't wait. Neither should you.

Why Charlottesville Chooses State Farm

One of the ideal times to get Life insurance can be when you're just starting out. Whether you decide to go with coverage for a specific number of years level or flexible payments with coverage to last a lifetime or another coverage option, State Farm agent Greg Leffler can help you with a policy that can help protect your loved ones.

If you're a person, life insurance is for you. Agent Greg Leffler would love to help you find out the variety of coverage options that State Farm offers and help you get a policy that's right for you and your loved ones. Call or email Greg Leffler's office to get started.

Have More Questions About Life Insurance?

Call Greg at (434) 296-1010 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Tips for managing life insurance after divorce

Tips for managing life insurance after divorce

Not sure how a divorce will affect your life insurance policy? Consider these tips for managing your insurance policies after divorce.

Irrevocable life insurance trust for a single person

Irrevocable life insurance trust for a single person

Estate taxes are imposed on all assets in an estate. Pay some of those taxes using an irrevocable life insurance trust.

Greg Leffler

State Farm® Insurance AgentSimple Insights®

Tips for managing life insurance after divorce

Tips for managing life insurance after divorce

Not sure how a divorce will affect your life insurance policy? Consider these tips for managing your insurance policies after divorce.

Irrevocable life insurance trust for a single person

Irrevocable life insurance trust for a single person

Estate taxes are imposed on all assets in an estate. Pay some of those taxes using an irrevocable life insurance trust.